How Rollover Rep Uses Forecastr To Pressure-Test Growth Plans and Drive Confident Decision Making

Enable data-driven decisions

Model a new revenue strategy

Partner with financial

planning experts

Tyler Laracuente didn’t follow the typical path into a leadership role at Rollover Rep. For years, he supported the team part-time, helping improve internal systems and modernize the tech stack. By the time he joined full-time in 2022, he already had a deep understanding of the business and how it operated.

But Tyler brought something new to the table: hands-on experience with Forecastr from a previous venture-backed startup. That experience fundamentally shifted how he viewed forecasting — not just as a fundraising tool, but as a smarter, more efficient way to run a company.

Even though Rollover Rep wasn’t looking to raise capital or take on outside investors, Tyler still saw real value in building a dynamic, forward-looking financial model. “The same financial and operational questions come up either way,” he said. From his perspective, Forecastr wasn’t just a capital-raising tool — it was a smarter, faster way to run the business.

|

Location: San Diego, CA |

Before Forecastr: A Model That Couldn’t Keep Up

Like many startups, Rollover Rep initially managed its financial modeling in spreadsheets. Tyler Laracuente, with his background in economics and computer science, had built his fair share of spreadsheet models. But even with that expertise, the limitations were obvious.

“Spreadsheets are miserable,” he said. “Just adding something as simple as a new revenue stream could take days. And once you’re done, it’s still hard to explain or share with others. One wrong edit, and the whole thing breaks.”

That fragility didn’t just slow things down — it created real barriers inside the business. Forecasting started to feel like a siloed, backend task, disconnected from the team’s day-to-day decision-making. The model was technically functional, but practically unusable. “The communication would have failed,” Tyler said. “Even if I’d built the same model in Excel, I don’t think I could’ve gotten buy-in from the rest of the team.”

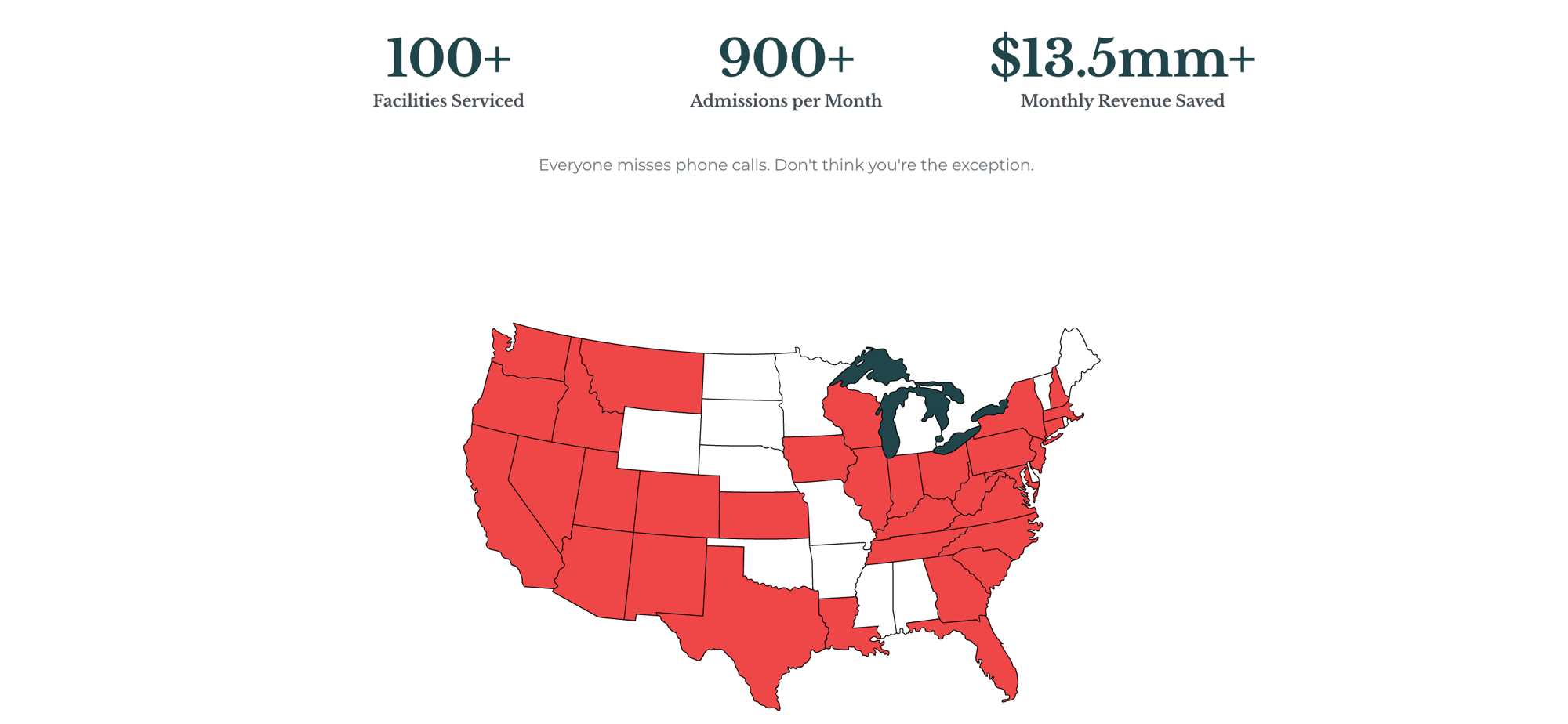

Rollover Rep's impact

Making Confident Operational Decisions

Like many startups, Rollover Rep initially managed its financial modeling in spreadsheets. Tyler Laracuente, with his background in economics and computer science, had built his fair share of spreadsheet models. But even with that expertise, the limitations were obvious.

|

CEO Profile |

|

|

Home: San Diego, CA |

|

“Spreadsheets are miserable,” he said. “Just adding something as simple as a new revenue stream could take days. And once you’re done, it’s still hard to explain or share with others. One wrong edit, and the whole thing breaks.”

That fragility didn’t just slow things down — it created real barriers inside the business.

Forecasting started to feel like a siloed, backend task, disconnected from the team’s day-to-day decision-making. The model was technically functional, but practically unusable.

“The communication would have failed,” Tyler said. “Even if I’d built the same model in Excel, I don’t think I could’ve gotten buy-in from the rest of the team.”

Running a Bootstrapped Business with Investor-Level Discipline

Even without external capital, the Rollover Rep team holds itself to a high operational standard. “We don’t have a board. We don’t have investors. But we’re still sitting in the same room every week, asking the same questions,” said Tyler Laracuente. “Where’s the cash needed? What are the implications of this hire? What does the next big investment look like?”

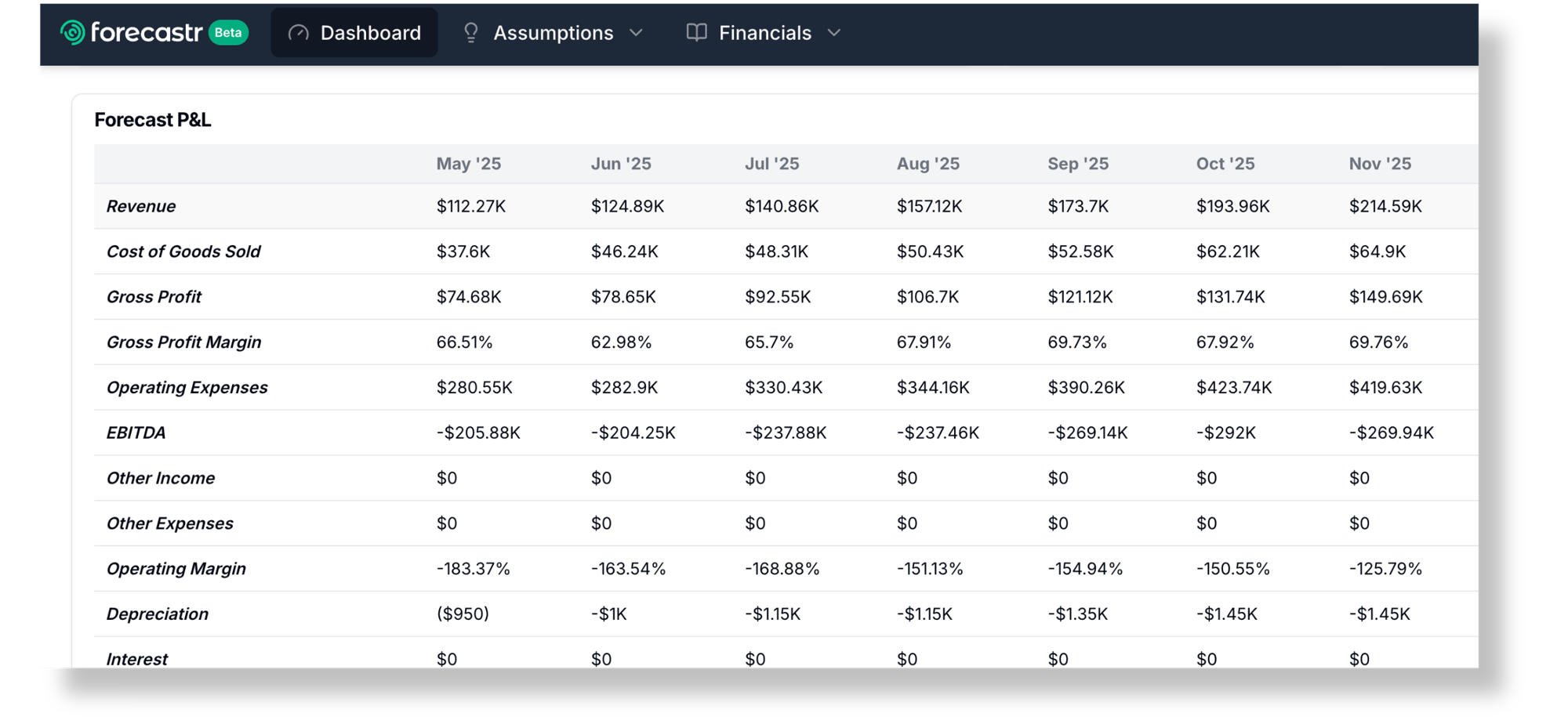

Forecastr helps bring structure and clarity to those conversations, not just by visualizing the numbers, but by making financial strategy part of how the team operates day-to-day. It helps Rollover Rep manage their runway, assess the real impact of business decisions, and optimize for sustainable growth.

Forecastr's financial modeling platform

“It’s easy to write off some of the stuff investors ask for as a waste of time,” he said. “But a lot of it is just good business practice. The way we use Forecastr is not about satisfying stakeholders. It’s about building a healthier business for ourselves.”

| "Scenario planning in Forecastr drives real operational decisions. It’s our core use case—we rely on it to test everything before we make decisions." | |

|

- Tyler Laracuente |

|

A Partner That Scales With You

Tyler didn’t just praise the platform. He also emphasized the value of working with Forecastr’s team. “The managed service piece is incredible,” he said. “We talk internally about how we can make our own systems feel more like Forecastr. It’s a real model for what great product-service integration looks like.”

He gave high marks to their analyst, Jordan. “Sometimes I’ll send Jordan an email asking how to do something, and I’ll get a reply that says, ‘Done — already updated in your model.’ That kind of support is just really, really valuable.”

Tyler is direct about Forecastr’s value. “I’d defend the sticker price right away,” he said. “It’s absolutely worth it. Not just in terms of value, but in terms of actual cash. If you’re asking financial questions that matter to your business, it’s a no-brainer.”

He added that Forecastr changed the way financial conversations feel inside the business. “They’re not intimidating anymore. They’re engaging. They’re about opportunity and vision. That’s a big deal — and it’s made a big difference.”