How LaderaAI Uses Forecastr To Raise Capital and Build a More Confident Plan for Growth

Upgrade an existing financial model

Confidence and

clarity with investors

Partner with financial

planning experts

Dave Goulden isn’t new to startups. In fact, he’s helped build eight of them—four as a founder. So when he launched LaderaAI, a generative AI platform that acts as a virtual data analyst for mid-sized businesses, he brought a wealth of experience with him. But this time, Dave wanted to do things differently: move faster, plan smarter, and build a stronger financial foundation right from the start.

LaderaAI solves a real problem for growing companies: making sense of their data. Teams can ask practical, business-driving questions—about sales performance, customer behavior, or operations—and get clear answers pulled from across their tech stack. It’s a powerful solution for businesses that don’t have the resources for a full-blown data team but still need reliable insights to make informed decisions.

To bring that vision to life and raise outside capital for the very first time, Dave knew he needed more than just a spreadsheet. He needed a financial model that was fast to build, easy to understand, and built to withstand investor scrutiny.

|

Location: Redwood City, CA |

From Spreadsheet Pain to Investor Confidence

Like many experienced founders, Dave Goulden began his financial planning with a spreadsheet. It had all the usual complexity—hiring plans, intricate formulas, and multiple tabs filled with assumptions.“It worked, but it was a pain,” Dave admitted.

Things changed after he attended a webinar hosted by Forecastr’s founders through the Founders Network. At first, Dave didn’t think he needed another tool. But once he saw Forecastr in action, he quickly realized this wasn’t just software—it was a smarter way to plan and grow.

What really stood out wasn’t just the platform itself, but the hands-on support that came with it. “I was super impressed. The tool is great, but the magic is having an analyst. I’ve got someone I can talk to who gets it, has been around startups, and understands what we’re doing.”

LaderaAI website

That someone was Faisal, a Forecastr analyst who quickly became a key part of the LaderaAI team. Dave could easily share assumptions or business updates, and Faisal would turn them into a clean, professional financial model, ready to present to investors. Often, it only took a few hours.

When LaderaAI’s go-to-market strategy shifted, updating the entire revenue forecast didn’t take days or weeks—it took about an hour.

Raise Capital with Clarity and Speed

Raising a $2 million pre-seed round isn’t just about telling a compelling story—it’s about backing it up with numbers that make sense. For Dave Goulden, that meant building a financial model that was detailed, flexible, and investor-ready. With Forecastr, he got exactly that—plus the expert guidance to make every assumption count.

|

Founder Profile |

|

|

Home: Redwood City, CA |

|

Forecastr didn’t just provide a modeling tool; it gave Dave a finance professional on his team who helped him pressure-test assumptions, compare growth paths, and ultimately land on a strategy that felt both ambitious and realistic. “We started with the typical VC model—$100M in five years. Then we reassessed. We built a seed-strapped scenario: $35M in five years, cash flow positive. That’s the one I can stand behind.”

With Faisal’s support, Dave created a model he could confidently share with investors. He walked them through key metrics, fielded follow-up questions with ease, and presented a financial narrative that felt clear, structured, and credible. That level of preparedness stood out, especially for a company still in its early stages.

Just as importantly, Forecastr made it easy to switch between different growth scenarios—whether Dave was showing an aggressive scale-up or a more conservative, resource-efficient plan. That adaptability helped him tailor his pitch depending on the audience. “I shared the model with an investor just last week. It was visualized, structured, and easy to explain. That makes a huge difference.”

Gain Financial Insights That Drive Better Decisions

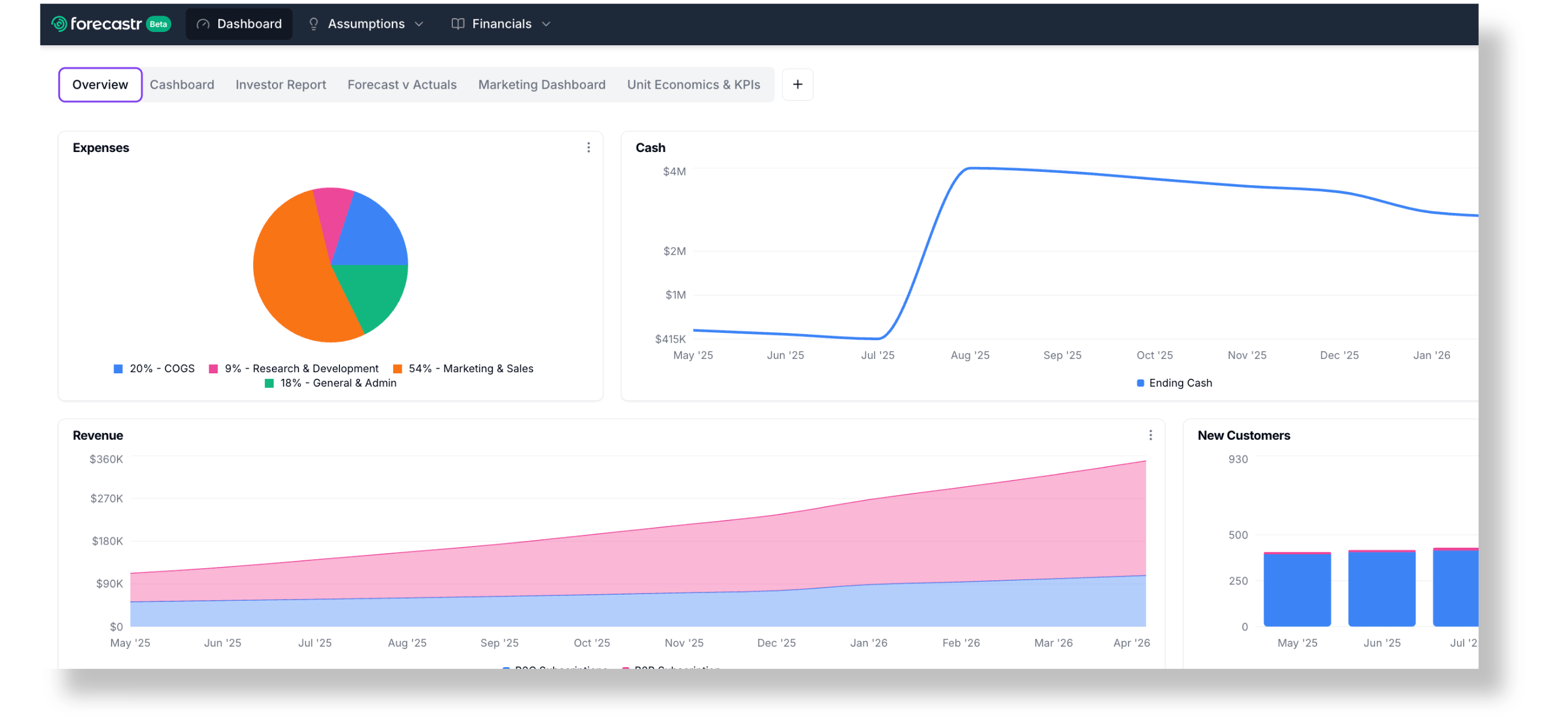

For LaderaAI, Forecastr didn’t just help with external fundraising—it became the internal source of truth. Dave and his team use the model to align revenue goals, hiring plans, and customer acquisition metrics. “It’s our system of record. Our revenue targets, churn assumptions, CAC—it’s all there and connected.”

With regular monthly check-ins, Dave works alongside his dedicated Forecastr analyst, Faisal, to keep the model updated and relevant. These sessions are more than just number tweaks—they’re a chance to revisit assumptions, explore what-if scenarios, and sharpen strategy as the company scales. “We update, adjust, and get smarter every time,” Dave said.

Forecastr's financial modeling platform

And for a founder managing a lean team, having an analyst ready to implement updates quickly, while providing strategic input, saves time and increases confidence. Whether preparing for a board meeting or mapping out a new hire, the model helps Dave make decisions with fewer blind spots. “It’s fast. It’s clean. And having someone like Faisal in your corner—that’s the real advantage.”

| "Before Forecastr, I had a spreadsheet with a million tabs and messy formulas. Now I can test pricing and growth models in minutes." | |

|

- Dave Goulden |

|

Why Forecastr Remains Essential

“Forecastr’s combination of a user-friendly platform and dedicated analyst support has been a game-changer for us,” says Dave Goulden. “It’s not just about building models; it’s about having a partner who understands our business and helps us navigate financial planning with confidence.”

That relationship has allowed LaderaAI to stay agile, make smarter decisions, and step into investor conversations fully prepared. From early fundraising to long-term planning, Forecastr has been a constant source of insight and support.

By giving Dave a finance professional on his team, Forecastr has helped LaderaAI raise capital successfully and optimize operational efficiency, and YES, all without adding the overhead of a full-time finance hire.