How Grow Your Cashflow Uses Forecastr To Uncover Growth Levers and Build With Clarity

Upgrade an existing financial model

Enable data-driven decisions

Partner with financial

planning experts

Pascal Wagner started Grow Your Cash Flow after navigating an urgent and deeply personal challenge. When his father passed away, he was left to help his mother generate income from the assets she inherited. Traditional financial advice fell short. Pascal spoke with countless advisors, experimented with different approaches, and eventually found a path forward through real estate fund investments.

That experience exposed a broader gap: most people don’t know how to generate meaningful income from the assets they already have. So he created Grow Your Cash Flow—a company dedicated to helping others learn the same lessons, but without the painful trial-and-error.

Today, the platform provides education and access to institutional-grade real estate funds, helping individuals generate reliable passive income and build long-term financial clarity.

|

Location: Miami, FL |

Leaving Clunky Models Behind

Before Forecastr, Pascal Wagner built multiple financial models in Excel to track performance and plan for growth. But as his business scaled, those models simply couldn’t keep up. Even with the support of bookkeepers and accountants, the spreadsheets became unwieldy, quickly outdated, hard to maintain, and nearly impossible to adapt on the fly.

Every minor update meant chasing formulas, reformatting charts, and cross-referencing multiple tabs. Testing different growth strategies or evaluating new opportunities required building entirely new sheets from scratch, wasting time without delivering deeper insight.

“I was trying to figure out where the leverage points were,” Pascal recalls. “You can run calculations in Excel, but it’s not built for forecasting. It doesn’t help you answer big-picture questions.”

Grow Your Cashflow's service

Interestingly, Pascal Wagner had once considered building a financial forecasting tool himself while working at a previous startup. He saw firsthand how difficult it was to build reliable models that actually supported strategic decision-making.

Years later, while serving as a fund manager at Techstars, Pascal came across Forecastr, which was then a portfolio company. This time, it all clicked. He joined as a board observer, got to know the founding team, and began using the platform personally. Over time, what started as a promising tool became an essential part of how he runs his business.

Although Pascal explored other forecasting solutions along the way, Forecastr remained his go-to, both because of the platform's power and the strength of the team behind it.

Financial Insight That Drives Smarter Decisions

What Pascal Wagner really needed wasn’t just a better spreadsheet—it was a clearer understanding of how his business operated beneath the surface. Forecastr gave him that clarity.

|

Founder Profile |

|

|

Home: Miami, FL |

|

From the start, Forecastr did more than just provide a tool—it brought a finance professional onto Pascal’s team. His analyst, Jordan, wasn’t there to simply plug in numbers. He acted as a strategic partner—someone who could challenge assumptions, structure messy financial data, and build a model that truly reflected how Grow Your Cash Flow worked.

Jordan’s ability to translate complex financial concepts into clear, founder-friendly language was a major part of that transformation. He didn’t just help set up formulas—he helped Pascal understand the story behind the numbers. That made it easier to align financial planning with broader business strategy, giving Pascal the clarity he needed to prioritize the right initiatives at the right time.

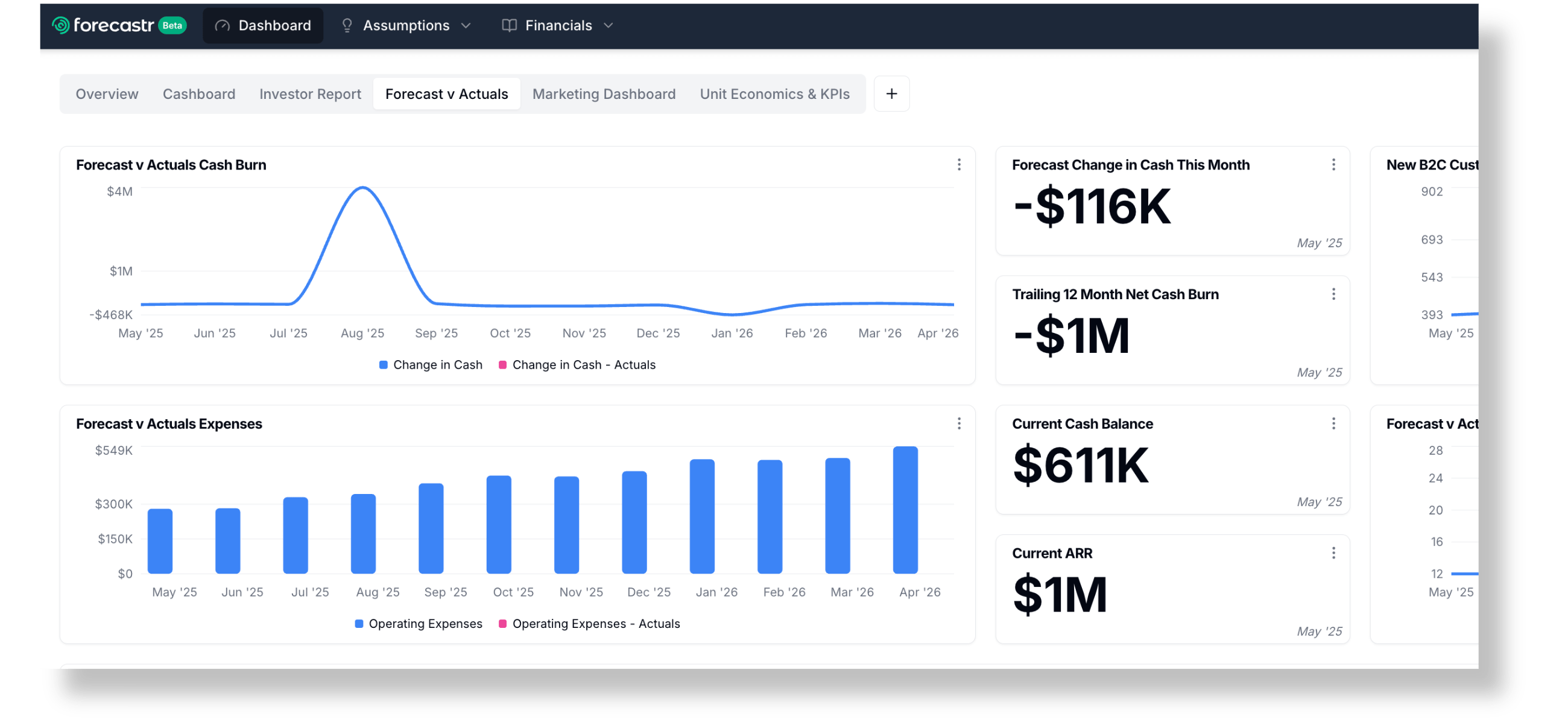

With Forecastr, Pascal could now test ideas, stress-test assumptions, and answer critical questions like, Where should we focus? What’s our highest-ROI growth channel? Is this strategy worth pursuing?

Instead of relying on disconnected spreadsheets, Pascal now had one unified system—a living model that could keep pace with the complexity of a growing company. And unlike past models that quickly went stale, Forecastr evolved as the business evolved, becoming a dynamic foundation for strategic thinking. “It helps answer: is this business worth pursuing? Where should we focus? What are our biggest growth levers? Those are the insights I get from the tool.”

Turning Goals Into Actionable Plans

Clarity isn’t just nice to have—it’s what turns goals into results. With Forecastr, Pascal was able to work backwards from the outcomes he wanted and map out exactly what it would take to achieve them. The platform helped him build a data-driven roadmap for growth, supported by a financial model that adapts alongside his evolving business.

Pascal didn’t just want static forecasts—he needed a model that could flex as strategies changed. Forecastr gave him the confidence that his assumptions were grounded in reality. It translated high-level vision into specific, measurable steps. And when the business pivoted or new opportunities arose, the model could pivot too, without requiring hours of manual updates.

Forecastr's financial modeling platform

That same clarity also made it easier to align the team. With everyone able to see how each initiative impacted revenue, margin, or cash flow, strategy became more than just talk—it became trackable, explainable, and actionable. As Pascal refined his business, that constant feedback loop kept him moving forward.

Instead of struggling with disconnected spreadsheets, he could now log in, adjust a lever, and instantly see the impact. It was a faster, smarter way to make decisions—and set growth targets he could actually hit. “It helps me understand what inputs we need to hit our goals. It helps clarify the path.”

| "Forecastr helped me answer: Is this business worth pursuing? Where should we focus? What are our biggest growth levers? That insight has been critical." | |

|

- Pascal Wagner |

|

Building a Company with Clarity

Forecastr has become a foundational part of how Pascal runs and scales Grow Your Cash Flow. It’s helped him stay focused on what matters most—identifying high-impact opportunities, avoiding distractions, and making confident, data-backed decisions.

With a dynamic financial model that evolves with the business, and the ongoing support of a dedicated finance professional, Pascal doesn’t just track his numbers. He understands them. That clarity allows him to make smarter decisions, faster. Whether he’s planning for growth, managing his runway, or setting quarterly targets, Forecastr ensures his strategy is always grounded in real data.

Forecastr isn’t just a tool—it’s a key part of how he builds and scales confidently.