How Brond Uses Forecastr To Build Operational Clarity and Look Like a Venture-Backed Business

Increased clarity with investors

Precise performance goal tracking

Partner with financial

planning experts

When Nick Phillips joined Brond as CEO in November 2024, he stepped into a business that was already gaining traction but also facing growing pains. Brond had its roots as a profitable operating company, generating $700K–800K in annual revenue. But with a fresh round of investment, the company was ready to evolve.

“Part of the recent investment we got was to take that operating business, double down on what works, and expand the product offering,” Nick explained.

Brond is a men’s digital health clinic that delivers telemedicine services with a direct, accessible, and trustworthy approach. That approach resonated with early customers and created strong demand. But behind the scenes, the company needed to level up.

With complex revenue streams emerging and a more ambitious growth plan in place, Brond needed to professionalize its financial operations. That meant more than just accurate books—it meant forecasting cash flow, managing burn rate, and building investor-ready financial models.

|

Location: Clarksville, IN |

When Google Sheets No Longer Cuts It

Before partnering with Forecastr, Nick Phillips—like many founders—was building his financial model manually in Google Sheets. He pulled data from QuickBooks, wrote formulas from scratch, and tried to keep everything stitched together as the business scaled. “I was creating that from scratch and muscling through it a bit before moving it into a tool,” he said. “It was all manual, and a very cumbersome process.”

But the challenges Brond faced couldn’t be solved with basic spreadsheets. The company had a complex business model—quarterly subscription billing, two separate provider networks for telehealth, and ad spend that needed to scale dynamically with revenue. Accurately forecasting all of this was not only time-consuming but also risky.

Nick understood those risks well. With a background in venture capital, he had seen firsthand how messy or inconsistent models can kill deals. “If you’re doing a deal with an investor, time is your biggest enemy,” he said. “The longer you delay, the more likely the deal falls through. Sending spreadsheets back and forth doesn’t cut it.”

Brond's website

With a background in venture capital, Nick had seen firsthand how investors view inconsistent or convoluted models. “Having to look through manual Excel or Google Sheet models is painful and exhausting for investors,” he said. “It raises red flags.”

Nick Phillips first heard about Forecastr through a network of founders and investors, many of them based in Kentucky, just like Brond. The hometown connection was a plus, but what really won him over was the product experience.

“Forecastr has a unique differentiator. It’s more founder-friendly—especially if you’re not totally financially savvy as a founder,” he said. “Once I can visualize the data, I can do a lot with it.”

Forecastr didn’t just hand over software and send him on his way. From day one, Nick was paired with a dedicated analyst who helped structure the financial model, ask the right questions, and ensure everything stayed aligned with investor expectations.

“You’ve got to make certain investments to improve your business,” he added. “This is one of those things I’m happy to write a check for every month.”

A Strategic Finance Partner That Moves at Startup Speed

For Nick, Forecastr quickly became more than just a financial tool—it became a true extension of his team. His dedicated analyst, Jordan, wasn’t just there to plug in numbers. He became a strategic partner—someone Nick relied on to prepare for board meetings, evaluate performance, and continuously improve the model.

|

CEO Profile |

|

|

Home: Louisville, KY |

|

“Shoutout Jordan—he’s a great dude,” Nick said. “We just had a board meeting, and he helped me walk through what went well, what we missed, and where to tweak the model.”

That partnership wasn’t one-sided. Jordan didn’t just crunch numbers—he challenged assumptions, prompted better thinking, and helped refine the business logic behind the forecasts. “Having an extra set of eyes to ask prodding questions like, ‘Why are you doing it this way?’ or ‘Could you think about it another way?’ is super helpful,” Nick said.

Responsiveness mattered, too. When deadlines loomed, Forecastr moved fast. “You guys go above and beyond—emailing late into the night to get a quarterly report out,” Nick said. “That’s super awesome.”

The urgency was matched with understanding. “Everyone’s got a startup mindset,” he added. “You respect the urgency that founders have when something pops up.”

With that level of collaboration and support, Forecastr helped Brond lay a stronger financial foundation—one that could evolve with the company.

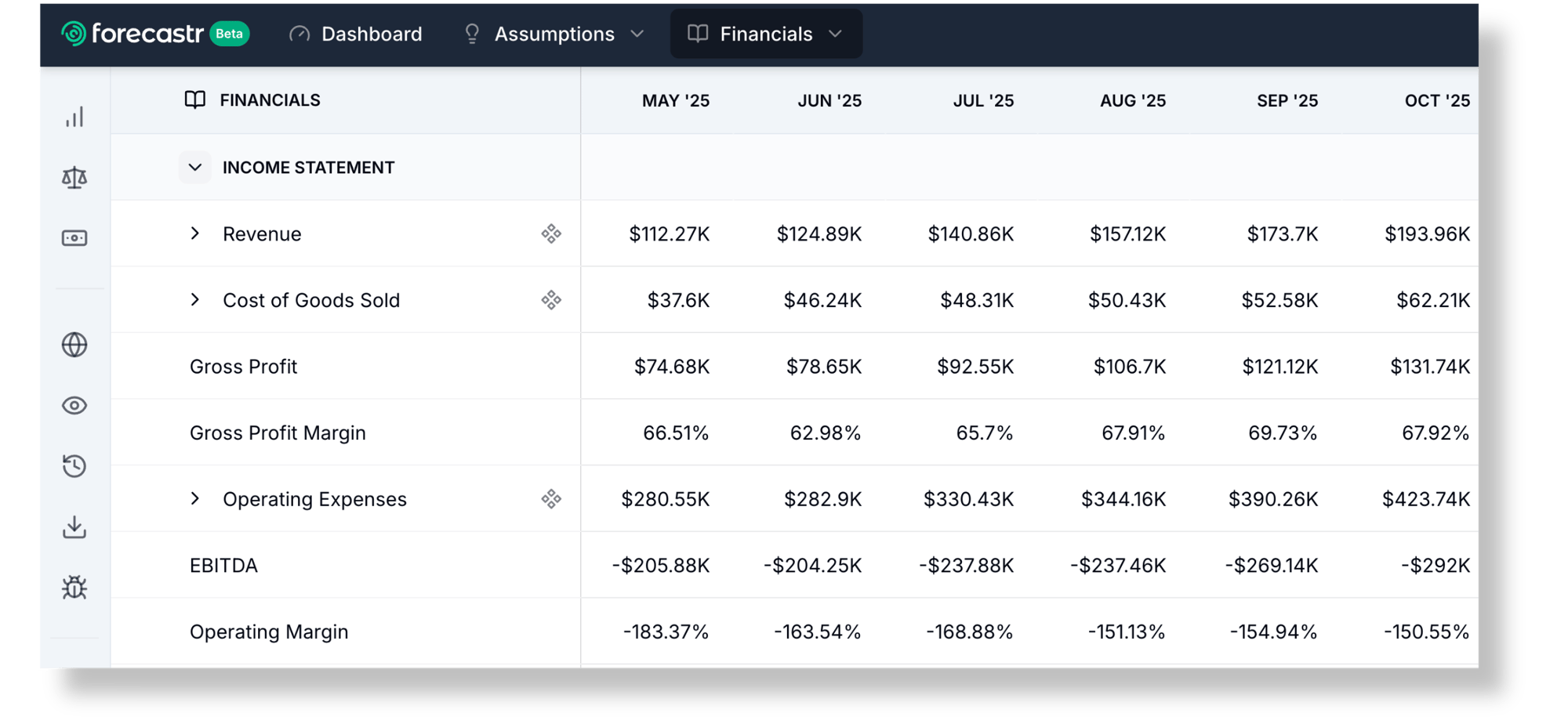

Real-Time Visibility That Drives Smarter Decisions

One of the biggest operational wins for Brond came from how Forecastr helped the team manage financial complexity in real time. With multiple moving parts—quarterly subscription billing, variable ad performance, dual provider networks, and a business line in transition—traditional tools just couldn’t keep up.

“From a forecasting perspective, it was difficult,” Nick said. “Having a team to help solve those problems—not just me—was valuable.”

With Forecastr, Nick gained a centralized platform to visualize the entire business in one place. That meant faster, more confident decision-making—without the risk or confusion of juggling disconnected spreadsheets. “It makes us look and feel more professional,” he said. “One dashboard. No long threads. No repeated charts.”

Using Forecastr’s sandbox environment, Nick could safely test what-if scenarios—adjusting salaries, customer acquisition costs, and marketing spend to see how different variables impacted cash flow and growth. “You have your main model, which investors might already have, and then you can create a copy to play with,” he explained. “That’s a safe way to test.”

The monthly and quarterly reports became key tools for goal-setting and accountability. “You can’t know what your goals are unless you can see them,” Nick said. “Having targets alongside your actuals—just one glance and you know what’s going on.”

That visibility gave him more control over the business. He could better manage cash flow, plan ahead, and keep both his team and investors aligned. “From a cash flow perspective, it’s a great visualization tool,” he said. “I’ve learned a lot about my own business.”

Operating Like a Venture-Backed Business

Nick Phillips brought a unique perspective to his role as CEO of Brond—he had previously been on the other side of the table as a venture investor. That experience shaped how he wanted the company to operate, especially when it came to raising capital.

“When you’re trying to raise from tier-one investors—as I know from my venture capital background—you have to look and feel like a successful, well-run business,” he said. “If you’re scrambling to pull your model together, sending new Excel sheets every few days, it creates noise. You look disorganized.”

Forecastr removed that noise.

Forecastr's financial modeling platform

With a structured, investor-ready model, real-time dashboards, and seamless updates, Nick could shift his focus from troubleshooting spreadsheets to telling a clear, compelling story. “We can make seamless updates and send a link—no long threads, no repeated charts,” he said.

That clean presentation helped him build trust. “If they don’t have a lot of follow-up questions, that’s a good thing,” he added. “It means they feel they already have what they need to make a decision.”

Internally, the model became a key leadership tool. It helped Nick understand how different inputs affected outcomes, when and how much capital to raise, and where to optimize for efficiency. “I feel empowered from a financial perspective as a founder,” he said. “And I feel like I’m providing clear, useful information to anyone who needs it.”

| "As a former VC, I hated Excel models during due diligence. Forecastr eliminates that pain with a clean, visual, digestible model that builds trust fast." | |

|

- Nick Phillips |

|

Build with the Right Financial Backbone

For Nick, Forecastr has become more than just a tool—it’s a key pillar in how Brond operates and makes strategic decisions. It bridges the gap between financial insight and execution, giving him the clarity to lead with confidence.

“It helps me, as a founder, understand what’s going on—where the inputs and outputs are, how to model cash flow, when to raise, how much to raise,” he said.

Combined with ongoing bookkeeping and analyst support, Forecastr shaped how Brond communicates with investors, sets growth targets, and plans for the future. Today, it’s embedded in the company’s financial foundation. “It’s not just a forecasting tool,” he said. “It’s part of the trifecta—your CPA, your analyst, and your model. That’s how you build something that lasts.”