How Albiware Uses Forecastr To Align Their Team, Raise Capital, and Build a Scalable Financial Infrastructure

Successfully raised $4.5M round

Clarify growth targets and team alignment

Partner with financial

planning experts

Alex Duta is the founder and CEO of Albiware, a fast-growing, venture-backed SaaS company that helps property damage restoration contractors run more efficient businesses. As a Y Combinator alum who has raised over $12 million in funding, Alex knew he needed more than just a basic forecasting tool – he needed financial operations that could scale with Albiware’s growth.

At first, the team turned to Pry, hoping it would bring structure and clarity to their financial forecasting. But the reality was anything but simple. “It was a thousand times harder to use than my Google Sheets,” Alex recalled. The platform required hands-on setup and constant maintenance, which defeated the purpose. “Somebody still had to operate it. It felt like programming in Excel spreadsheets.”

Even worse, it didn’t give him the visibility or confidence he needed. Reports lacked detail, performance was hard to track, and aligning with the board felt like guesswork. As CEO, Alex wasn’t looking for another tool to manage – he needed a true solution. One that could take forecasting off his plate, help him lead with clarity, and scale with the company’s growth.

|

Location: Oak Brook, IL |

Building Infrastructure That Scales

At the time, Albiware was generating under $3 million in ARR, growing fast, but not yet ready to bring on a full-time controller or CFO. “It just didn’t make any sense to have that in-house,” Alex said. But investor expectations were rising, and so were the demands of operating a fast-moving startup.

Alex knew he needed more than rough spreadsheets or a bare-bones forecast – he needed real infrastructure. “It was really hard to create a forecast for our board and our investors,” he said. “And it was even harder to track performance against that forecast.” Without a reliable system, he was constantly second-guessing the numbers and wasting time trying to make them work.

The tipping point came when he met the Forecastr team. “The minute we transitioned over, it felt like a weight was lifted off my shoulders,” he said. Instead of juggling spreadsheets and guesswork, he gained clarity, consistency, and a process he could trust.

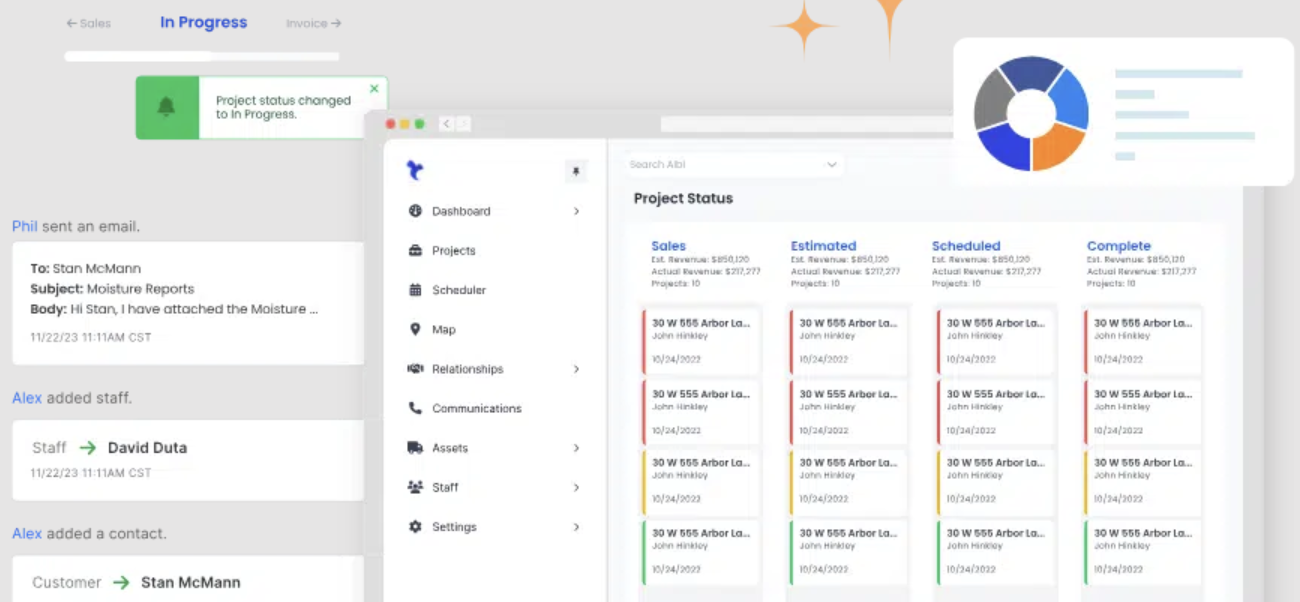

Albiware's platform

Forecastr didn’t just offer a tool – it delivered the backbone of Albiware’s financial operations. The engagement began with a deep audit of Albiware’s financials, followed by a hands-on, multi-month onboarding process. Alex Duta, CEO of Albiware, appreciated the transparency from day one. “They warned us ahead of time – it takes time to dial in your first model,” Alex said. “But after four or five months, we had a model that was really accurate.”

Today, the model isn’t static – it evolves with the business. The Albiware team partners closely with Forecastr to refine it on an ongoing basis. At their most recent leadership retreat, Forecastr joined the executive team to co-create the forecast for the upcoming year. “It was really cool,” Alex said. “The whole team is aligned around what we need to do to make doubling this year possible.”

The model has become more than a board-facing document – it’s a shared framework that guides planning, drives alignment, and supports smart execution across the company.

Strategic Clarity That Powers the Whole Organization

Today, Albiware meets monthly with Forecastr’s CFO team to review financials, assess performance, and shape forward-looking strategy. For CEO Alex Duta, the experience goes well beyond traditional reporting. “What makes Forecastr unique is the professional services arm on top of the software,” Alex said. “Most CEOs don’t want to use forecasting software. With Forecastr, you don’t need to. They use it for you.”

|

Founder Profile |

|

|

Home: Downers Grove, Illinois |

|

Each session isn’t just about numbers. It’s about turning vision into strategy, and strategy into measurable goals. Alex gets more than a snapshot; he gets a financial lens that helps him understand what’s really driving the business. “Josh Hinkle gets my vision and turns it into math that makes sense,” he said.

That clarity translates into smarter, faster decisions. Instead of looking at high-level metrics in isolation, the Albiware leadership team uses the model to tie revenue, margin, and burn targets directly to specific initiatives in product, sales, and marketing.

“It’s not just tracking performance – it’s measuring the right things, so we can act fast, stay accountable, and make better decisions as a team.” With Forecastr embedded in their operating rhythm, financial strategy becomes a shared responsibility, not a siloed task.

A Partner That Delivers on Fundraising and Ops

Forecastr’s impact goes far beyond forecasting. Through its embedded CFO services, the team helped Alex completely overhaul Albiware’s financial operations—streamlining workflows, upgrading systems, and taking ownership of back-office execution.

“We replaced our old bookkeepers with Forecastr’s CFO services,” Alex said. “They work with my EA and all my team members, so I don’t have to be in the weeds.” As he put it, “It’s like having a fully functional finance department without having to build one from scratch.” The result was smoother operations, better oversight, and more time for Alex to focus on growing the business.

Forecastr's financial modeling platform

One standout example: Forecastr helped build a custom integration with Stripe, paired with automated Python queries, to generate a monthly SaaS scorecard. Now, Alex gets a real-time view of key metrics like MRR, churn, and gross margin—no manual spreadsheet work required.

This automation has eliminated busywork and given the team accurate, up-to-date insights to drive decisions and execution across the business. And it’s paid off.

Since partnering with Forecastr, Albiware has raised an additional $4.5 million in capital – this time, with cleaner data, stronger investor materials, and much less friction. “The last $4.5M was a lot easier to raise than the first $8M,” Alex said. “That’s because of what the Forecastr team helped us build.”

| "We raised $4.5M after starting with Forecastr—and that was a lot easier than the first $8M." | |

|

- Alex Duta |

|

The Model, the Team, and the Confidence to Scale

For Alex Duta, having a financial model isn’t a “nice to have” – it’s a non-negotiable part of running a high-growth business. “You can’t raise money without one. You can’t align your team to an objective without one. It’s business-critical,” he said.

Forecastr gave him what Pry and spreadsheets couldn’t: a reliable process, a proactive team, and a clear lens into how the business is performing. With Forecastr, forecasting wasn’t just easier – it became actionable.

“Forecastr gave me confidence—not just in the numbers, but in the decisions that follow.” That confidence now powers everything from capital raises to internal planning. Whether Alex is preparing for his next funding round or aligning his team on quarterly goals, he has the clarity to move quickly and lead with conviction.